Act now to stop the irs from garnishing your wages. Thinkstock the economic crisis may be a distant memory for many, but for other. Fallen behind on your credit card bills? The irs will continue to take money with. If you have certain types of unpaid debts, the irs can seize your federal or state income tax refund even if it's already garnishing your wages.

But there are payment options for you to avoid garnishment.

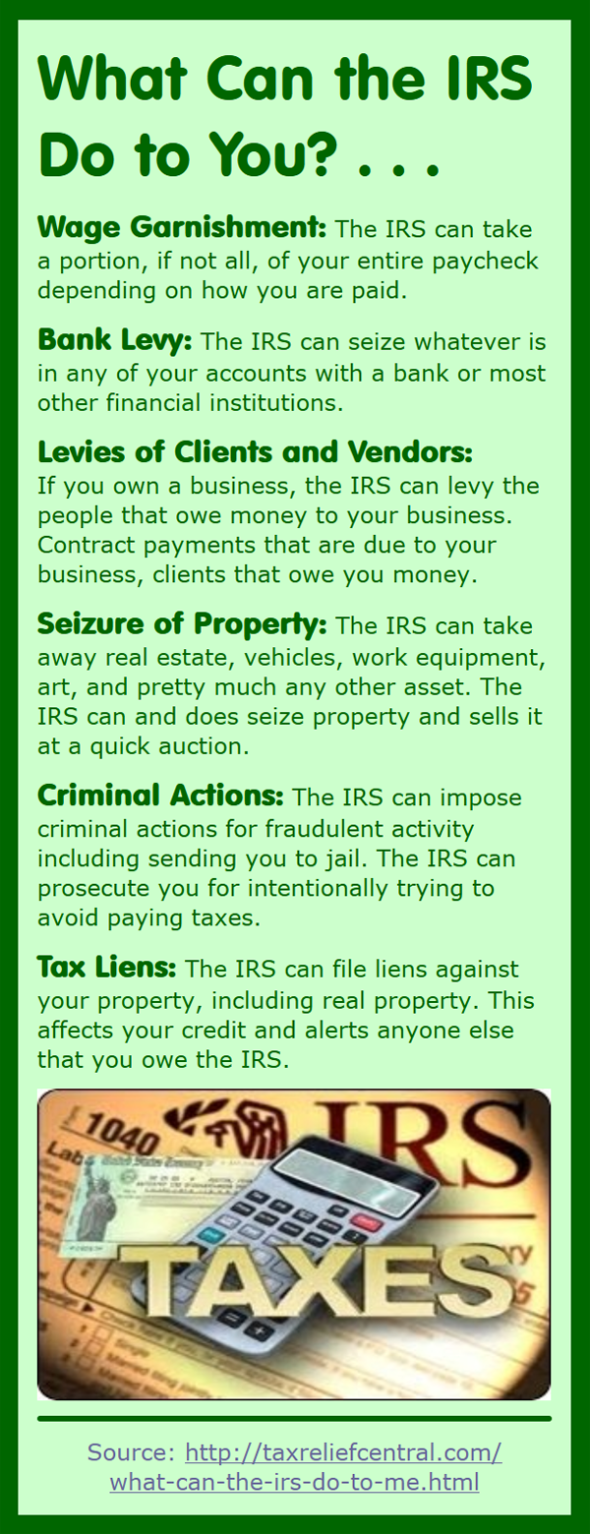

Wage garnishment lets creditors get repayment directly from your paycheck or bank account. State law determines the process creditors must follow to garnish wa. Around 80% of filers fall into this catego. Fallen behind on your credit card bills? If you're subject to a wage garnishment, what are your rights? With wage garnishment rates rising, your debt could cost you more than just your credit score. If you have certain types of unpaid debts, the irs can seize your federal or state income tax refund even if it's already garnishing your wages. Filing your taxes each year is a necessary part of adulting. But there are payment options for you to avoid garnishment. A court order for garnishment isn't required for child support, unpaid income taxes or federal student loan payments. Like most creditors, the internal revenue service (irs) has the power to garnish your wages if you owe a tax debt. In most cases, a creditor. Your wages may be subject to garnishment when you don't pay financial obligations.

But there are payment options for you to avoid garnishment. Filing your taxes each year is a necessary part of adulting. You receive notice that one of your employees is having their wages garnished. Around 80% of filers fall into this catego. Act now to stop the irs from garnishing your wages.

Filing your taxes each year is a necessary part of adulting.

Filing your taxes each year is a necessary part of adulting. State law determines the process creditors must follow to garnish wa. The irs will continue to take money with. Thinkstock the economic crisis may be a distant memory for many, but for other. In most cases, a creditor. Learn more about the laws surrounding wage garnishments and your obligations as an employer. Most of the time, you'll receive money back due to the overage you've likely paid to the federal government over the course of the year. Garnishment for consumer debts, such as. Wage garnishment lets creditors get repayment directly from your paycheck or bank account. But there are payment options for you to avoid garnishment. Like most creditors, the internal revenue service (irs) has the power to garnish your wages if you owe a tax debt. How long does it take to garnish wages?. If you are facing an irs wage garnishment, it is important to act fast in order to limit the impact it has on your financial wellbeing.

How long does it take to garnish wages?. Filing your taxes each year is a necessary part of adulting. If you owe taxes to the irs, it can garnish your wages to collect. If you are facing an irs wage garnishment, it is important to act fast in order to limit the impact it has on your financial wellbeing. If you're subject to a wage garnishment, what are your rights?

Your wages may be subject to garnishment when you don't pay financial obligations.

But they do not affect the opinions and recommendations of the au. You receive notice that one of your employees is having their wages garnished. Garnishment for consumer debts, such as. Product and service reviews are conducted independen. But there are payment options for you to avoid garnishment. If you're subject to a wage garnishment, what are your rights? Here's how it works and what to do if you're facing wage garnishment. Thinkstock the economic crisis may be a distant memory for many, but for other. Around 80% of filers fall into this catego. By barbara kate repa different rules, as well as different legal limits on how much of your paycheck can be garnished, apply to various types of debt. Wage garnishment is usually the result of a court judgment. The irs will continue to take money with. If you owe taxes to the irs, it can garnish your wages to collect.

48+ Lovely Irs Wage Garnishment / El Paso, TX Accounting, CPA Firm | Briana M. Gomez - Here's what you need to know about having your wages garnished.. A court order for garnishment isn't required for child support, unpaid income taxes or federal student loan payments. By barbara kate repa different rules, as well as different legal limits on how much of your paycheck can be garnished, apply to various types of debt. If you're subject to a wage garnishment, what are your rights? How long does it take to garnish wages?. Here's how it works and what to do if you're facing wage garnishment.